Related party means a Director major shareholder or person connected with such Director or major shareholder. All reviews by the AC are reported to.

Related Or Not Related What You Should Know About Related Party Transactions Azmi Associates

The arms length principle is based on a comparison of prices margins division of profits or.

. 1 RELATED PARTY TRANSACTION POLICY AND PROCEDURES 10 SCOPE As a public listed company Kim Hin Joo Malaysia Berhad the Company and its subsidiaries KHJ Group would in the ordinary course of business enter into transactions of revenue or trading in nature with a related party or parties. This threshold varies from S100000 in Singapore HK1 million in Hong Kong to MYR 250000 in Malaysia. Taxpayers would need to ensure that the related party transactions are at an arms length basis.

Purpose Prior studies suggest that most expropriation of firms resources is conducted through related party transactions RPTs. RELATED PARTY TRANSACTIONS Pursuant to the Listing Requirements subject to certain exemptions a related party transaction is a transaction entered into by a listed issuer or its subsidiary which involves the interest direct or indirect of a related party. 57 Related Party Transaction means a transaction entered into by the ompany or its subsidiaries which involves the interest direct or indirect of a related party.

Recurrent Related Party Transaction means a related party transaction which is recurrent of a revenue or trading nature and which is necessary for day-to-day operations of a listed issuer or its subsidiaries. Related party transactions to ensure that these transactions are carried out on normal commercial terms not more favourable to the related party than those generally available to the public and are not detrimental to the minority shareholders of the Company. Then on the other hand Paragraph 823 of the Main Marker Listing Requirements MMLR of the Bursa Malaysia Main Marker Listing Requirements MMLR specifies that except as otherwise provided for by law and subject to certain pre-conditions a public listed company or its non-listed subsidiaries can grant financial assistance in the form of advance payments guarantees and.

According to the IAS 24 standard related party transactions must disclose all information and transactions resources and services between a subsidiary and its parent companyotherwise either the ultimate controlling parties or the senior parents whichever is responsible for generating the financial statement must be disclosed Standard 2009. According to the Transfer Pricing Guidelines a transfer price is acceptable if all transactions between associated parties are conducted at an arms length price. Meaning of control and associated persons The Malaysian Guidelines refer to the definition of control in Section 139 of the MITA which defines control as both direct.

Listing Requirements of Bursa Malaysia Securities Berhad. B Related Party Transaction refers to a transaction entered into by the Company or its subsidiaries which involves the interest direct or indirect of a related party where the disclosure requirement is governed by percentage ratio threshold as detailed out in Part VII. The computation of the percentage ratio is provided in Part VIII.

Malaysia applies the arms length principle to determine the transfer price of transactions between related parties. A related party means in relation to a corporation a director major shareholder including any person who is or was within the preceding six months of the date on which the terms of the transaction was agreed upon a director or major shareholder of the listed issuer or of its subsidiary or holding company or person connected with such. This policy is designed to ensure the related party transactions rpts are carried out in the ordinary course of business are made at arms length and on normal commercial terms which are not more favourable to the related party or parties than those generally available to the public and are not on terms that are detrimental to the minority.

58 Recurrent Related Party Transaction means a related party transaction which is recurrent of a revenue or trading nature and which is necessary for day-to-day operations of the Company or its. Related party transactions is one of the critical tests of corporate governance. Related parties include the listed REITs substantial shareholders sponsors directors chief executive officer manager and trustee.

The Guidelines also cover transactions between a permanent establishment PE and its head office or its other related branches. The Malaysian tax authority is increasingly vigilant in scrutinising inter-company transactions of multinational as well as domestic groups of companies. Related party relationships are a normal feature of business and commerce.

B To comply with the Part E Rule 1008 and 1009 of the ACE Market Listing. Under listing regulations there is a minimum threshold to trigger the disclosure of an RPT. Or b it is a Recurrent Related Party Transaction.

Paragraph 1008 of the Listing Requirements stipulates the obligations that a listed issuer must comply with in relation to a related party transaction. Paragraph 1008 must be read together with paragraph 1009 of the Listing Requirements which is in relation to a Recurrent Related Party Transaction. In a tax audit the tax authority may make tax adjustments if they are of the opinion that the related party transactions are not conducted.

And domestic related party transactions are within the scope of the Guidelines. Rule 1002 i. Means a transaction entered into by the listed corporation or its subsidiaries which involves the interest direct or indirect of a related party.

Material related party transaction means a related party transaction with any related party involving an amount per transaction or contract in excess of RM250000 or 1 of the insurance or takaful fund surplus1determined at the end of the preceding financial year whichever lower. 025 or more a listed issuer must announce the related party transaction to the Exchange as soon as possible after terms of the transaction have been agreed unless - a the value of the consideration of the transaction is less than RM250000RM500000. Incorporated in Malaysia RELATED PARTY TRANSACTIONS POLICY AND PROCEDURES Page 1 10 OBJECTIVES a To outline the procedures for purpose of identifying monitoring evaluating reporting and approving related party transactions and recurrent related party transactions.

Related party transactions are a source for companies to operate separate parts of their activities through subsidiaries associates or joint ventures. Based on the conflict of interest view related parties opportunistically use their authorities to expropriate firms resources for their own benefits via RPTs subsequently increasing agency costs and reduce firm value.

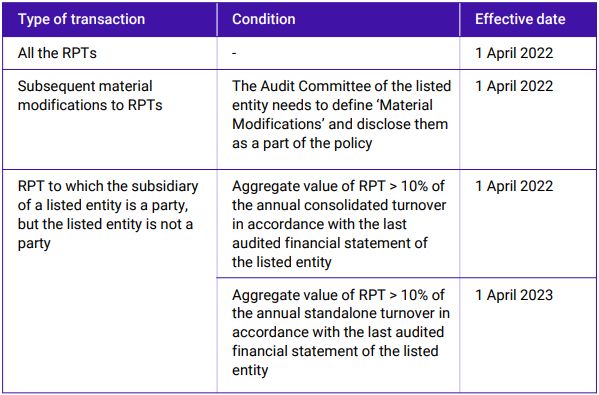

Amendments To Sebi Lodr And Its Impact On Related Party Transactions Shareholders India

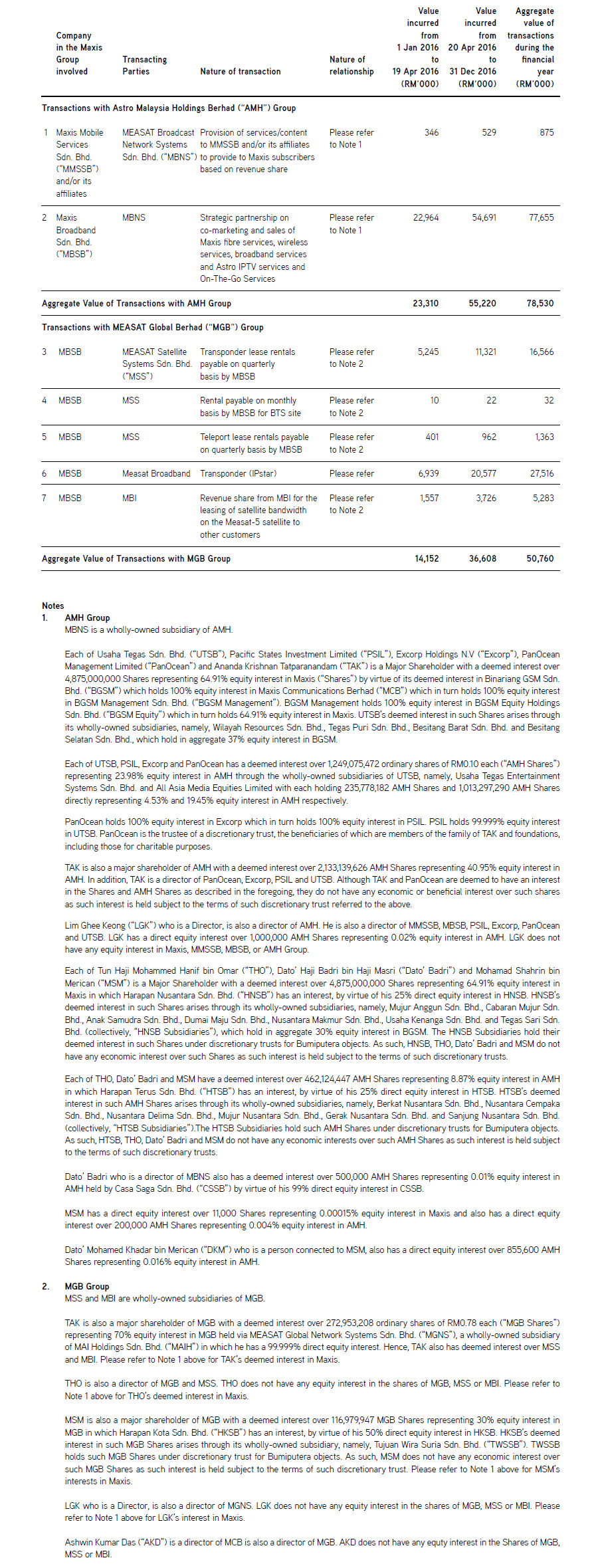

Disclosure Of Recurrent Related Party Transactions Other Information Maxis Annual Report 2016

Related Party Transaction Rpt A Closer Look

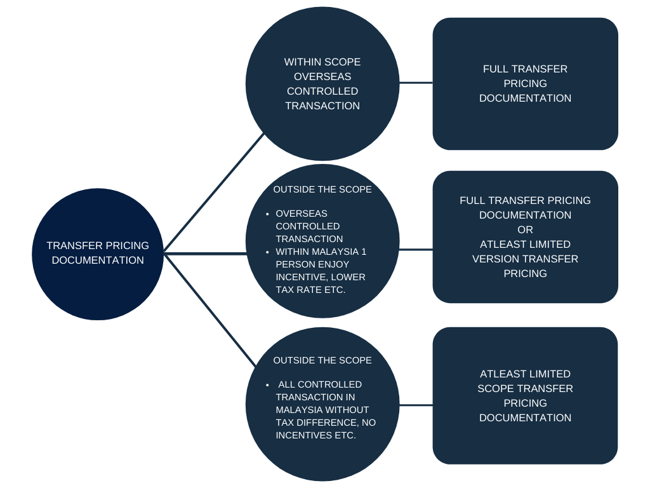

How To Prepare Transfer Pricing Documentation Cheng Co Group

Changes In Director Duties And Liabilities

Transfer Pricing Methods In India And Utilizing Third Party Service Providers

Related Or Not Related What You Should Know About Related Party Transactions Azmi Associates

Types Of Payment Systems Bank Negara Malaysia

Pdf The Impact Of Related Party Transactions On Performance And Valuation Of Malaysian Listed Firms Testing The Influence Of Corporate Governance Semantic Scholar

Pdf The Impact Of Related Party Transactions On Performance And Valuation Of Malaysian Listed Firms Testing The Influence Of Corporate Governance Semantic Scholar

Checklist To Determine Whether A Transaction Is Related Party Transaction

Related Or Not Related What You Should Know About Related Party Transactions Azmi Associates

Related Party Transaction Rpt A Closer Look

How To Prepare Transfer Pricing Documentation Cheng Co Group